web3 | product design | crypto exchange

CREATING EXCHANGE FOR digital and TOKENIZED ASSETS

Symbridge digital asset exchange built specifically for future-minded traders. My goal was to create end-to-end design from scratch and apply corporate branding, which was on parallel track.

role: IC Principal designer

initial hands-off: < 1 month

CI adaptation: 3 weeks

software costs: 1 FIGMA SEAT

role: IC Principal designer

initial hands-off: < 1 month

CI adaptation: 3 weeks

software costs: 1 FIGMA SEAT

project challenges and pecularities

Project timeline

Onboarded as IC

Kick-off and workshops week

First hands-off

CI delivery

Consulting on ecosystem CI

Research&Design

Feedback & change requests cycle

CI impl.

Design update

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sept

Oct

Nov

Dec

Jan

Feb

2019

2020

No established design process

I was the first designer onboarded and my task was not only create, well, design, but also setup the whole work environment, arrange collaboration with the developers and analytics.

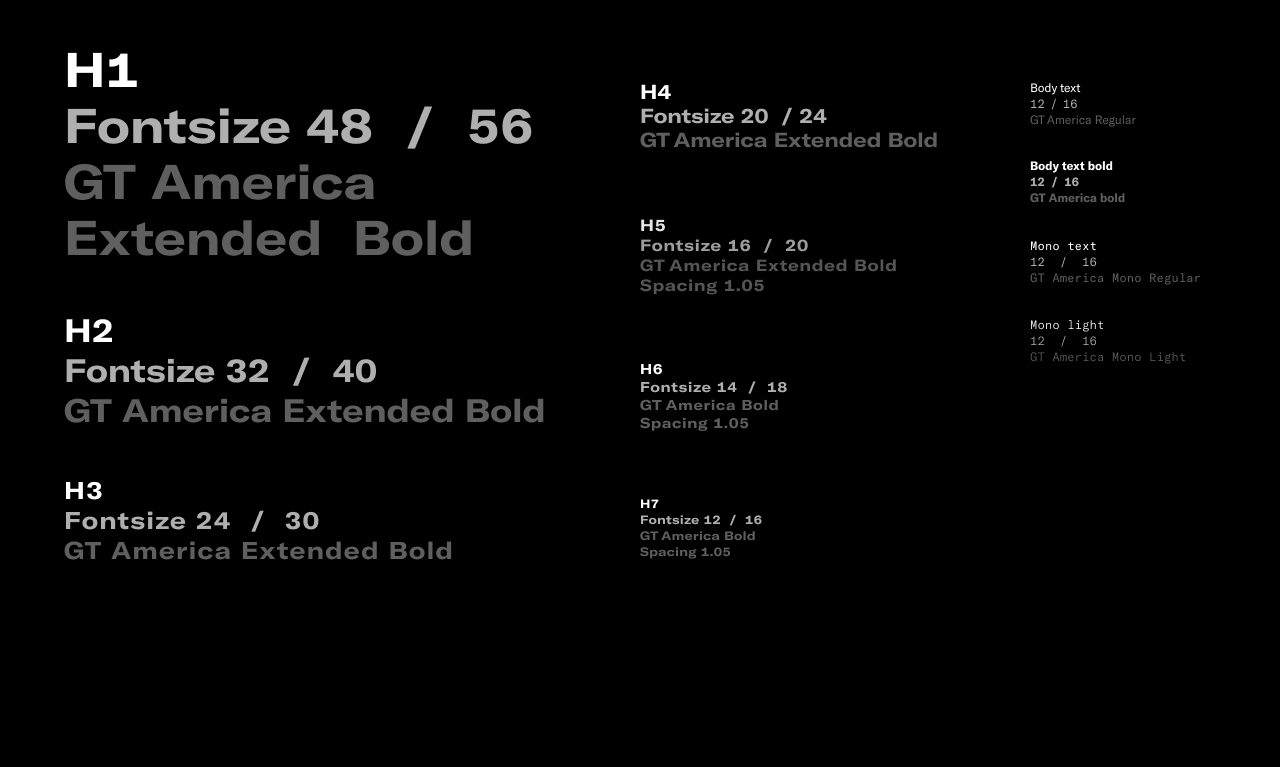

I've introduced modern product design principles like doing research first, focus on user needs, change request management. I also insisted on using Figma as the primary design tool for remote collaboration, hands-off, easy versioning.

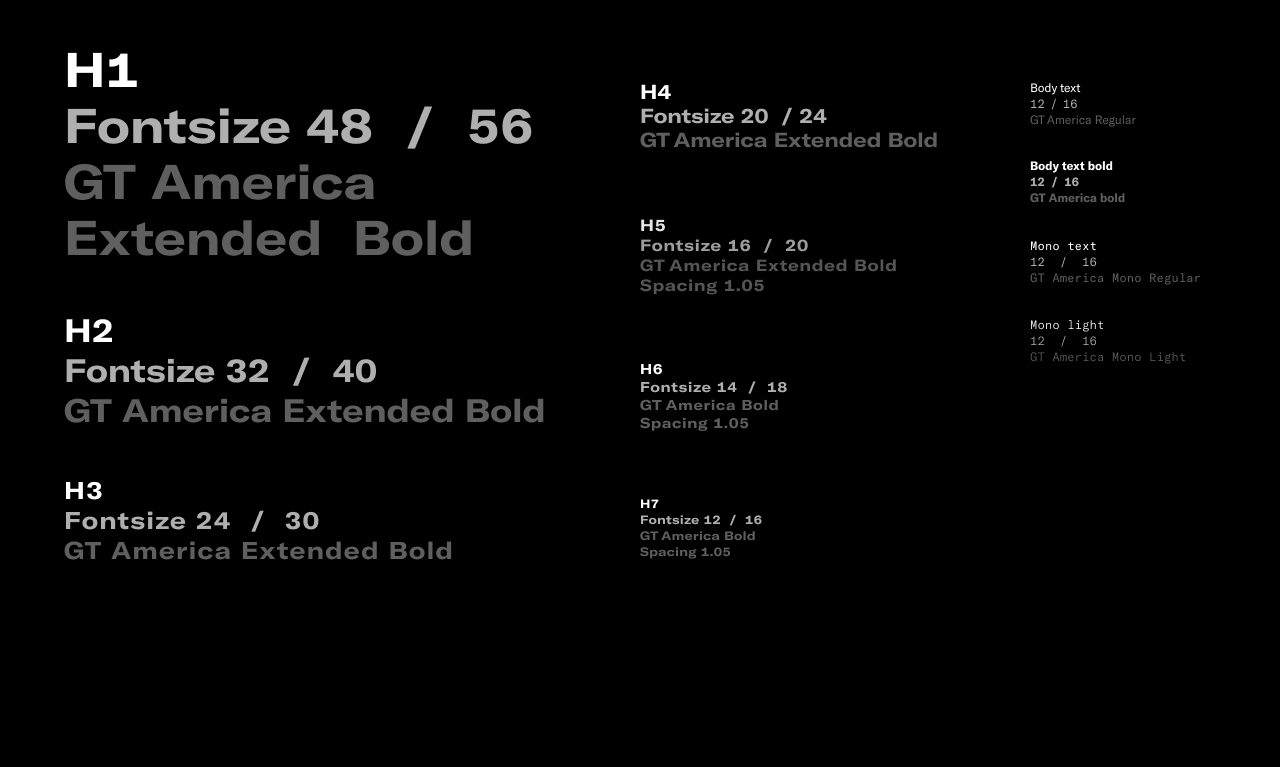

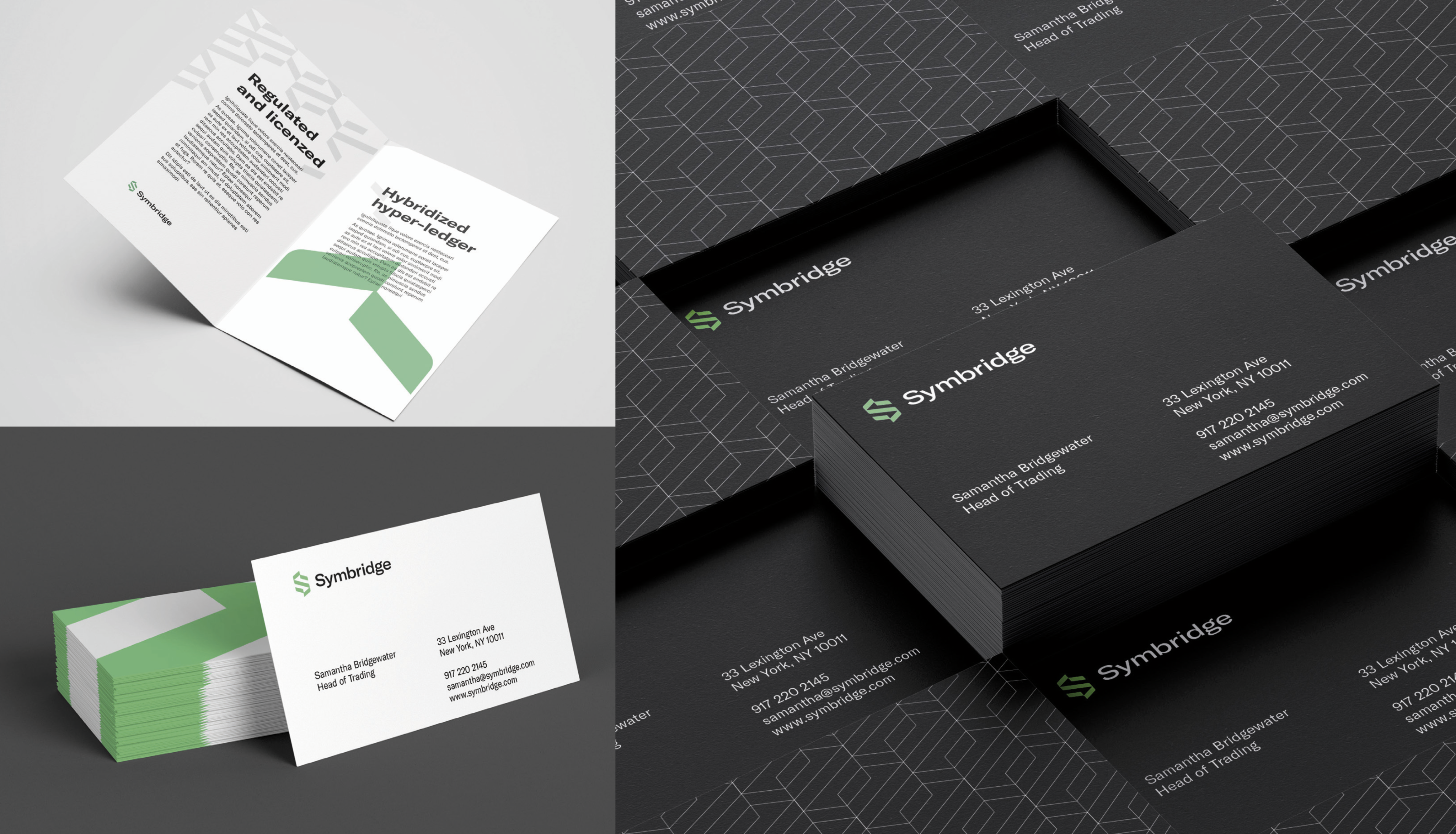

Working around visual pivot

I was involved in advising on branding creation process made by a Carbone Smolan Agency. With all client-side communication and decision making delays it was obvious we can not wait several months and need to start working on product.

I've split the project work into two major phases. The first one was focused on product features, user flows and design system, and the second one — on CI implementation, additional feedback-based updates and polishing.

Institutional focus

The product was focusing on institutional clients and market makers first while keeping wider audience. It added an extra level of complexity to the scope and included business features like Trading strategies, OTC trading, Subaccounts.

I've worked on design with both professionals and casual traders in mind and aimed for consistency, intuitive usability.

OTC TRADING

CONCIERGE SERVICE

SUBACCOUNTS

TRADING STRATEGIES

MARKET IMPACT CALCULATOR

VALIDATOR NODES

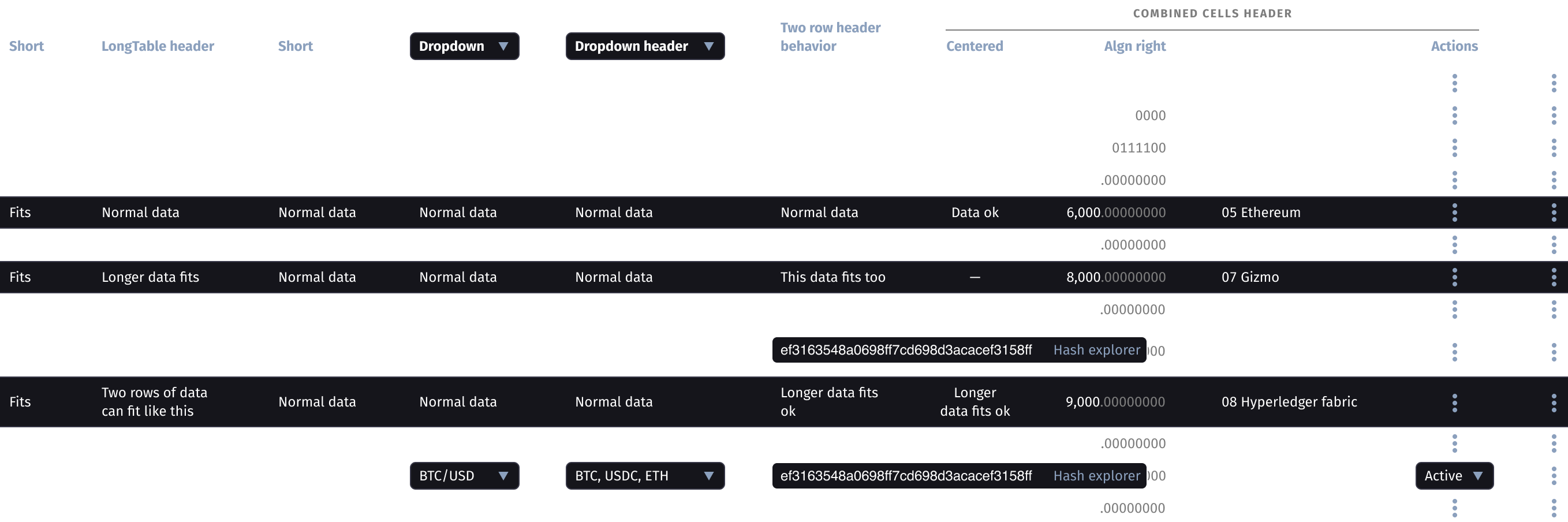

Regulated blockchain

Symbridge was built on a deeply customized Hyperledger Fabric, and required blockchain-related tools both for security and transparency. Crypto-specific tools like key generators or blockchain explorer were also included. And Validator nodes for extra transparency (and monetization!).

design process and validation

Iterative approach

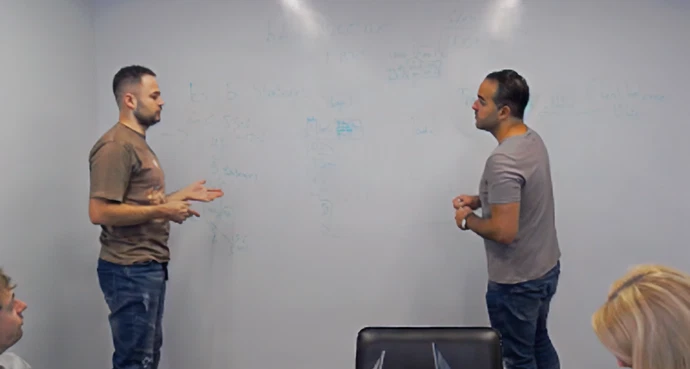

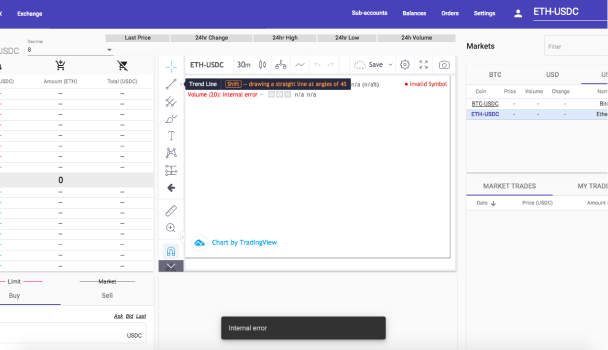

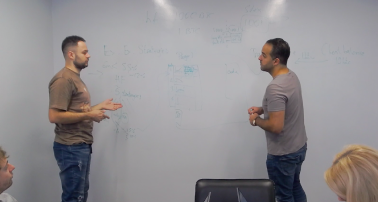

I believe in iterations in design. The whole Symbridge designing was built on multitude of iterations: ideas gathering and whiteboard validating them. Making early sketches and collecting feedback from the main stakeholders who were also professional traders and could help with usability and professional expectations. Iterating on visuals, working with feedback from the wider team and experts. Requesting peer review from other team members, including consultations on whether the proposed design can be implemented at all. Sometimes it could not, so I iterated further.

Stakeholder workshops

Obviously, there are no users in the early-stage startups. To get insights on what to include in design I've organised a week-long workshop series with professional traders and investors. I've conducted deep interviews, existing exchanges reviews and whiteboard sessions to gather ideas, insights and collect BRDs that affected the whole product.

Besides getting insights I used these workshops to connect with the analytics and development teams. We agreed on our internal workflows and also validated the most important feature ideas.

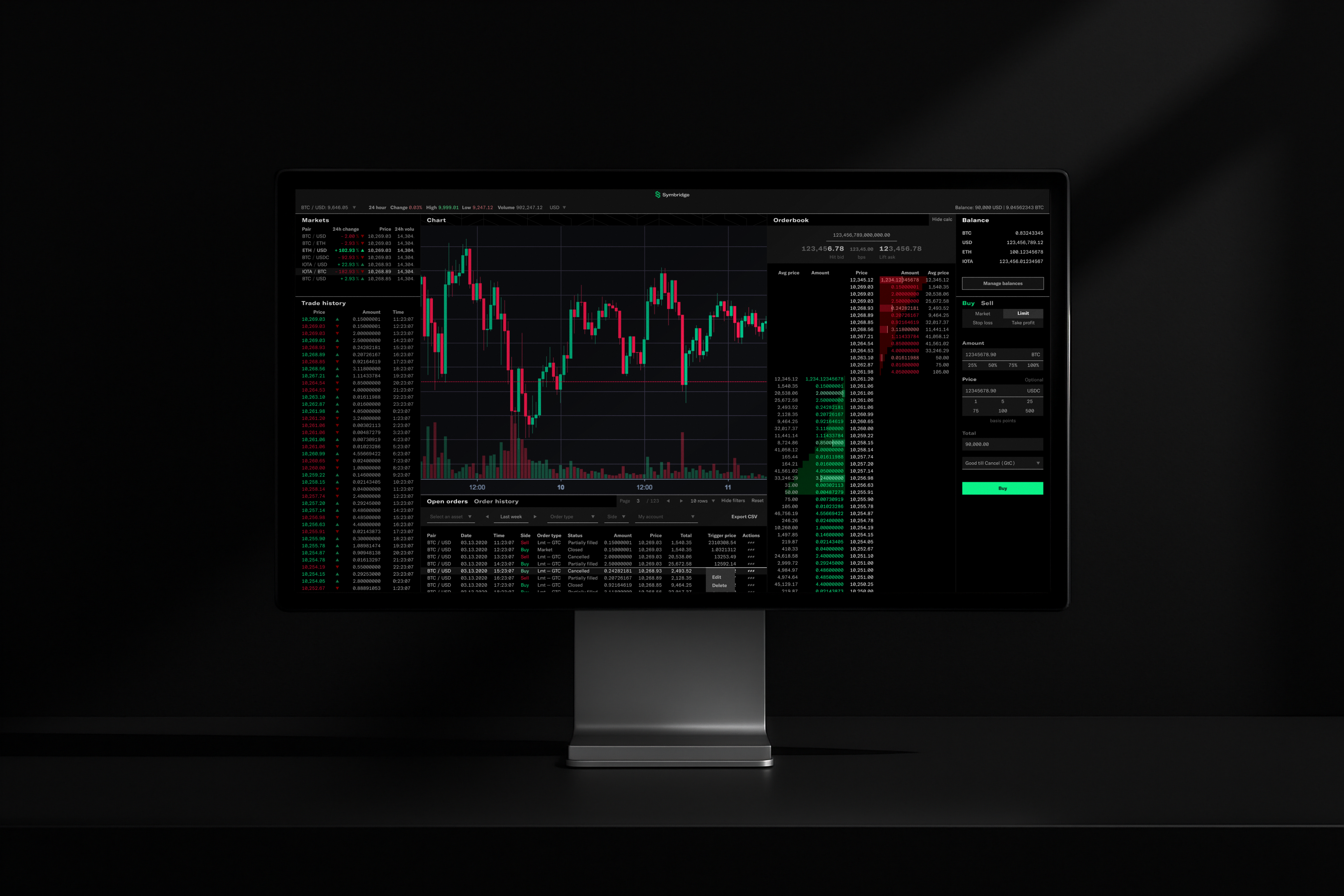

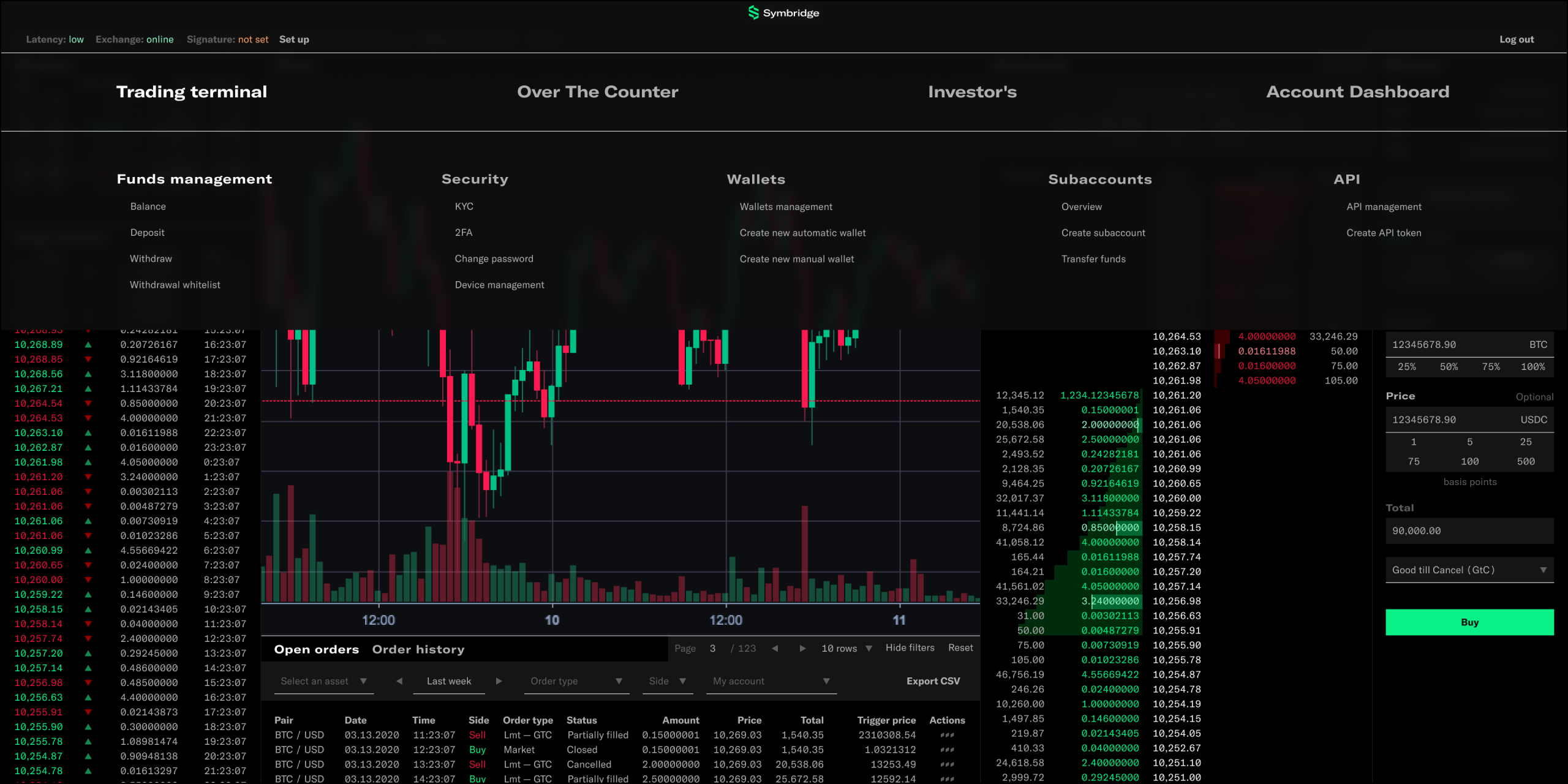

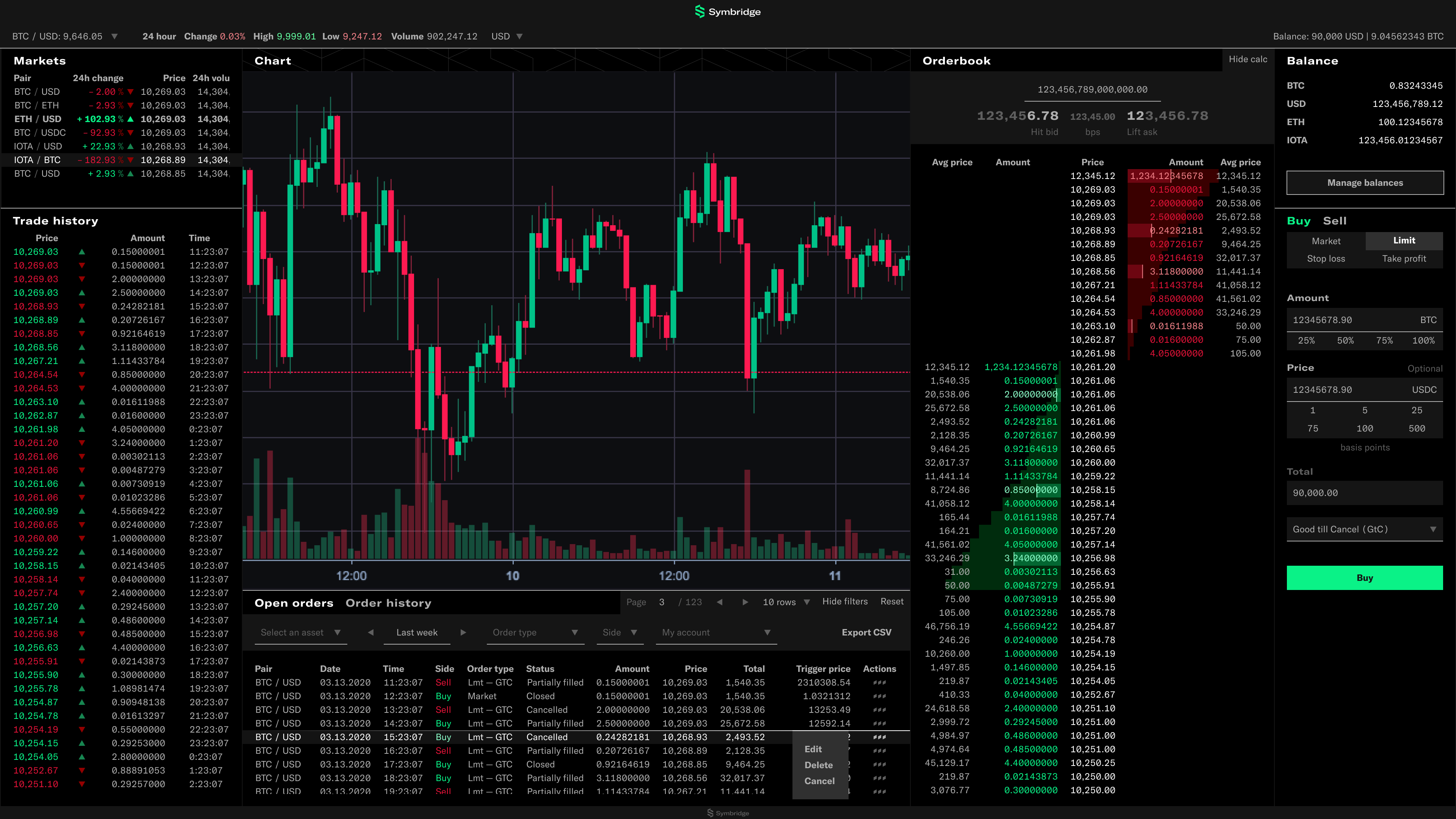

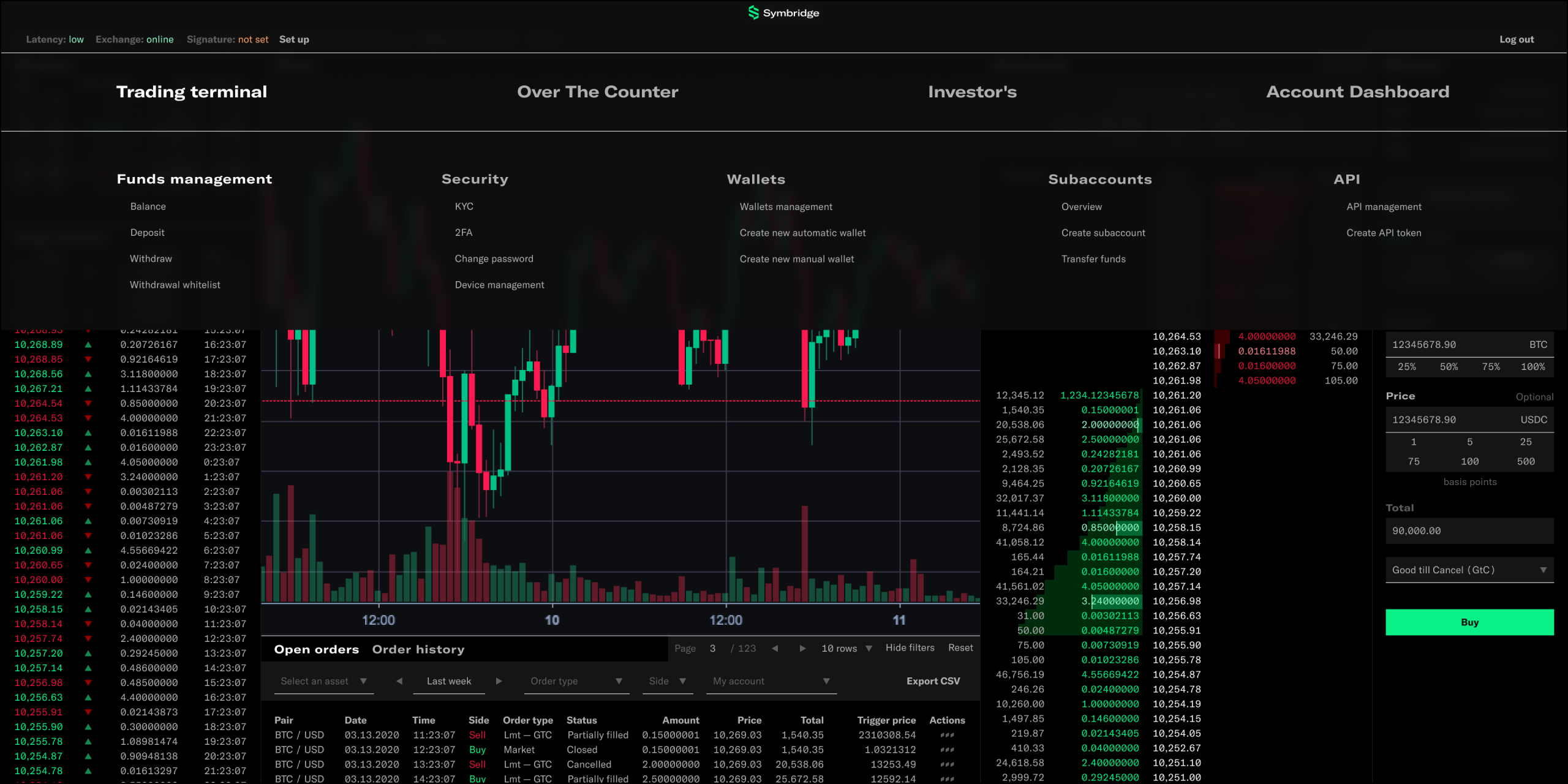

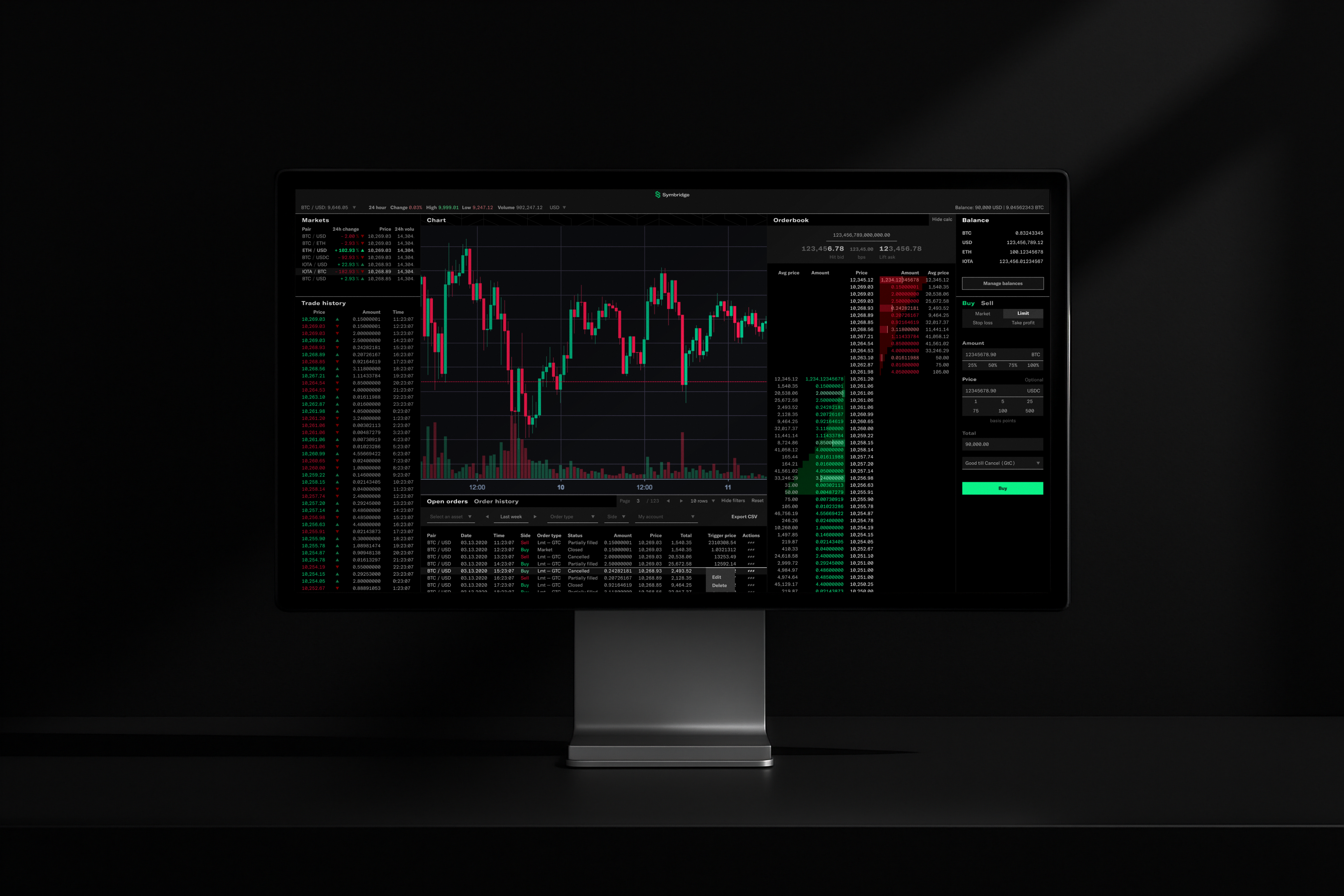

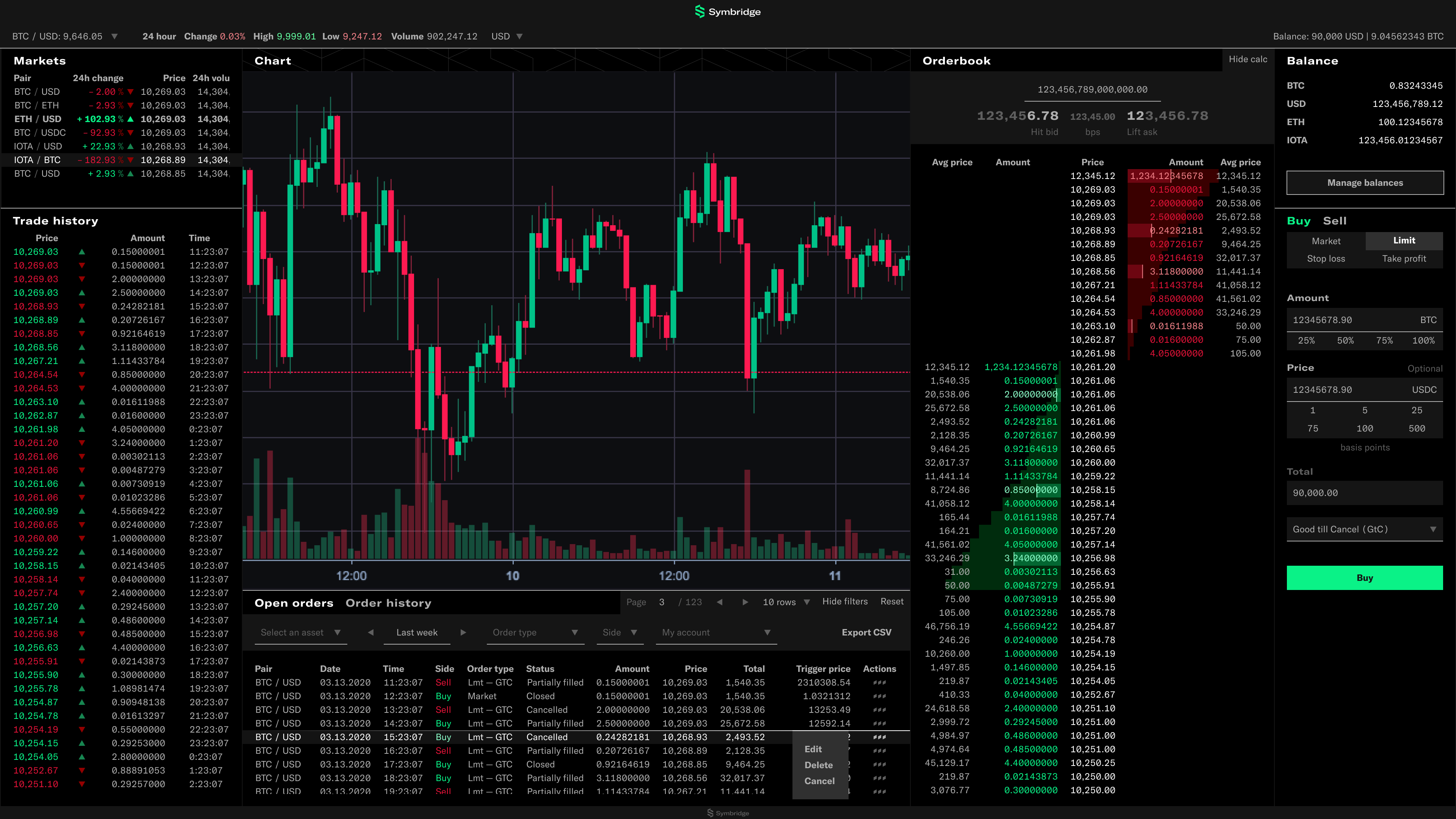

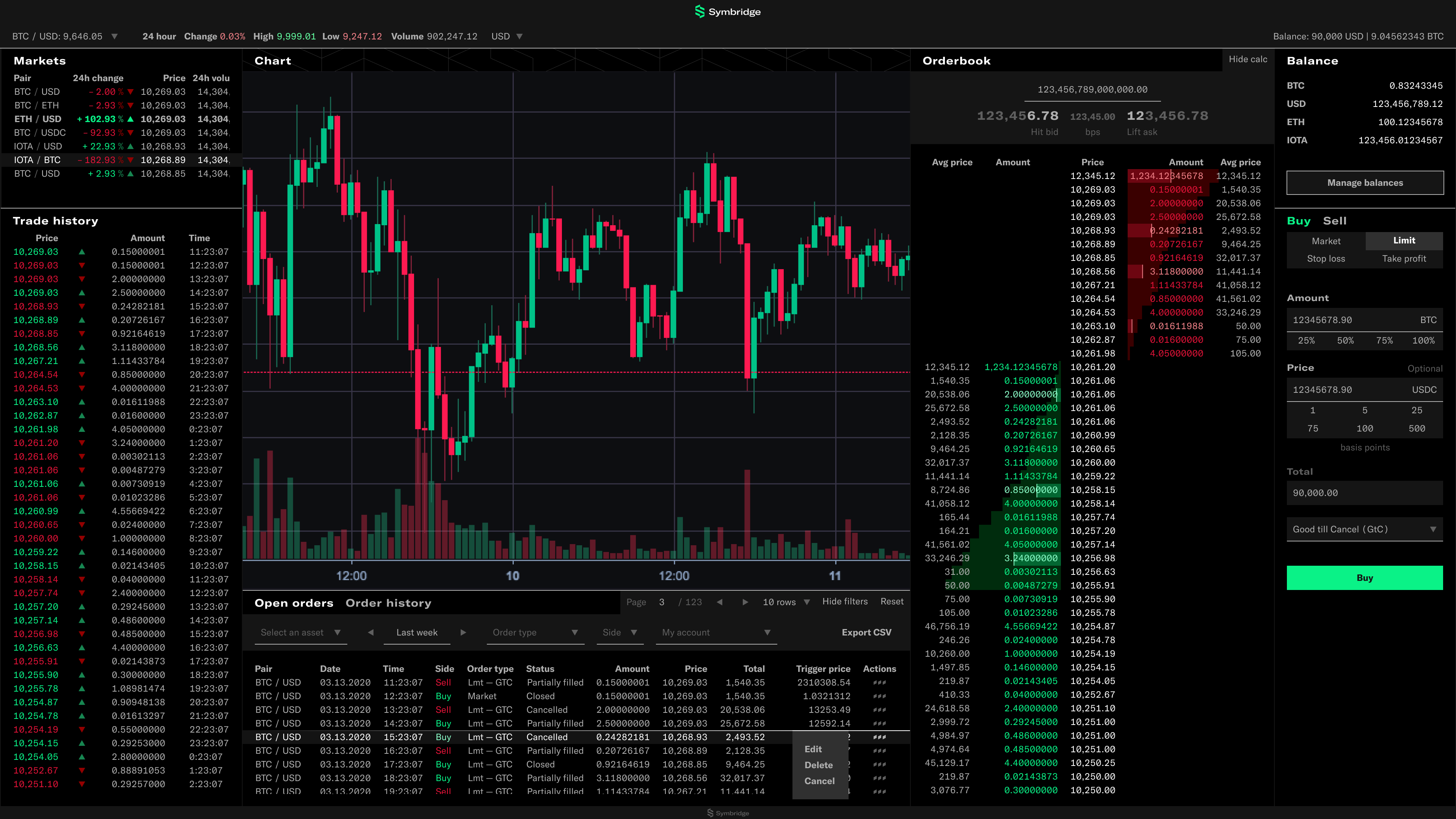

trading terminal

Classical trading exchange terminal — completely built anew to meet the highest trader's requirements.

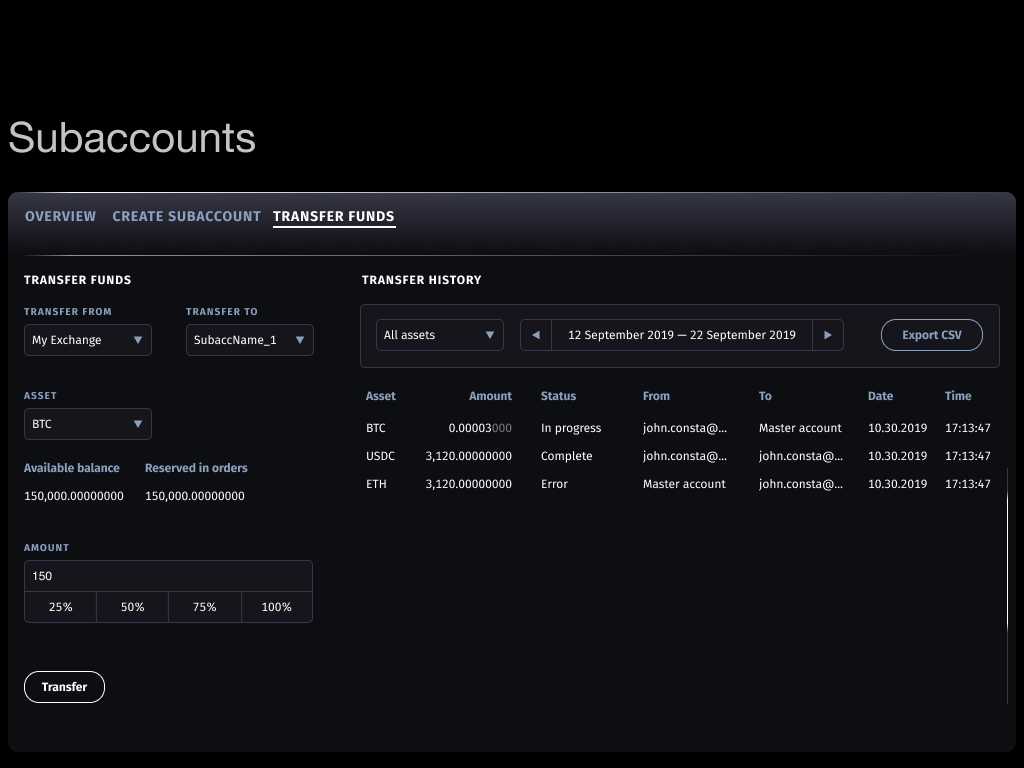

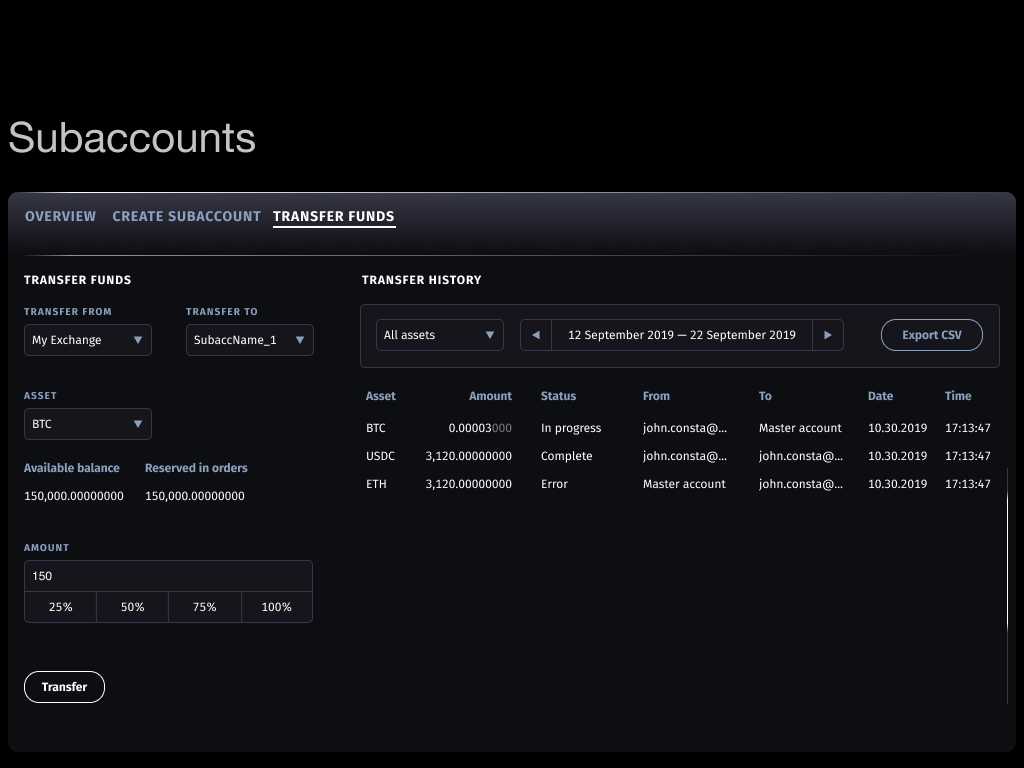

Subaccounts

An important feature for institutional clients that allows delegating funds to employees or subcontractors and trade on behalf of the owner.

Market impact calculator

Orderbook calculator to immediately estimate the impact of the order on the market

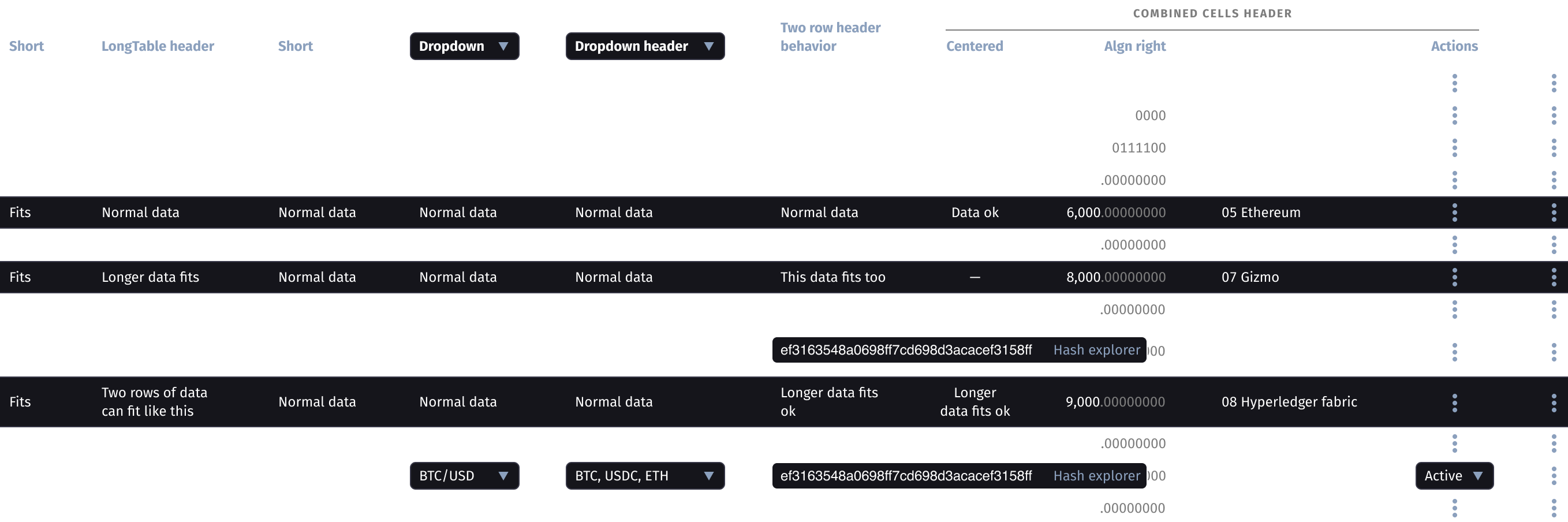

Design assets

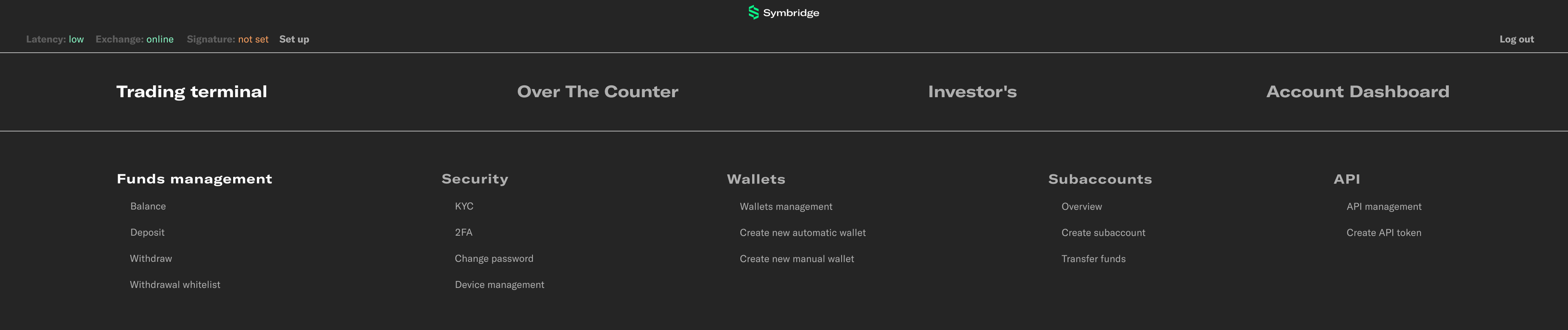

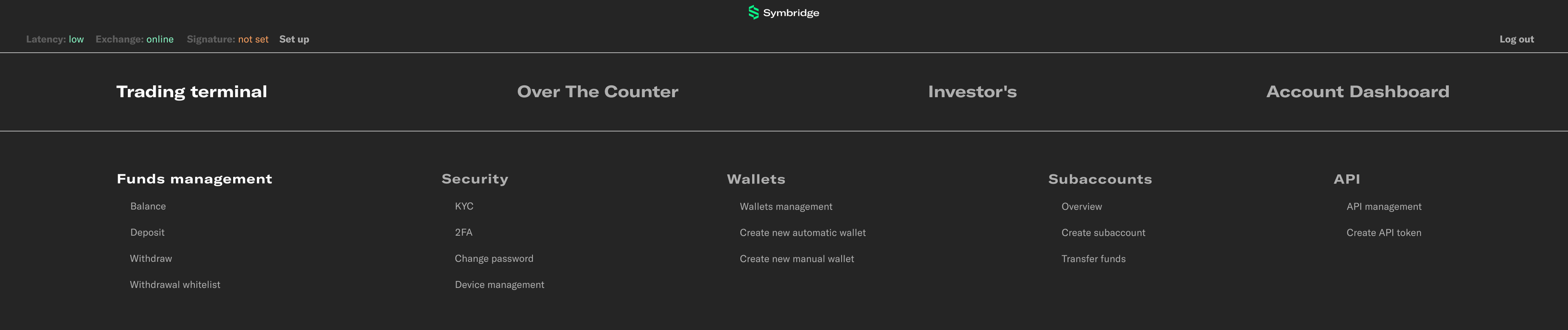

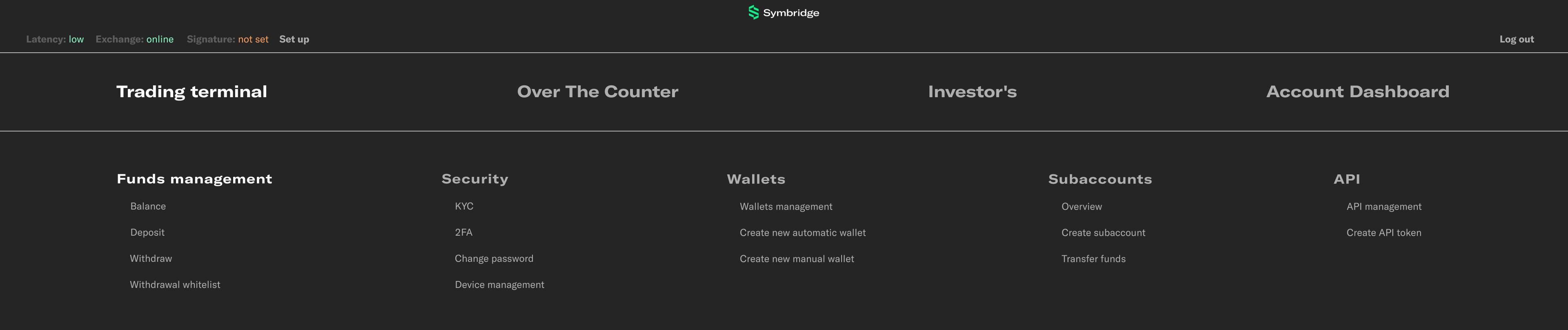

using navigation strategically

Navigation panel in Symbridge is the entry point to the internal products and is serving so many purposes:

- Addressing the complexity of the audience. Besides classical exchange terminal it incorporates access to institutional tools, OTC trading and other products.

- Providing clarity — fast and easy access to the most important features with hierarchy representation.

- Brand communication. Menu is accessed via logo, to establish habits of getting the best out of touching the brand. And no more burger menu!

- Technical information on latency, online status and other important settings. These would clutter UI and are not needed all the time, yet have to be easily accessible.

Subaccounts

An important feature for institutional clients that allows delegating funds to employees or subcontractors and trade on behalf of the owner.

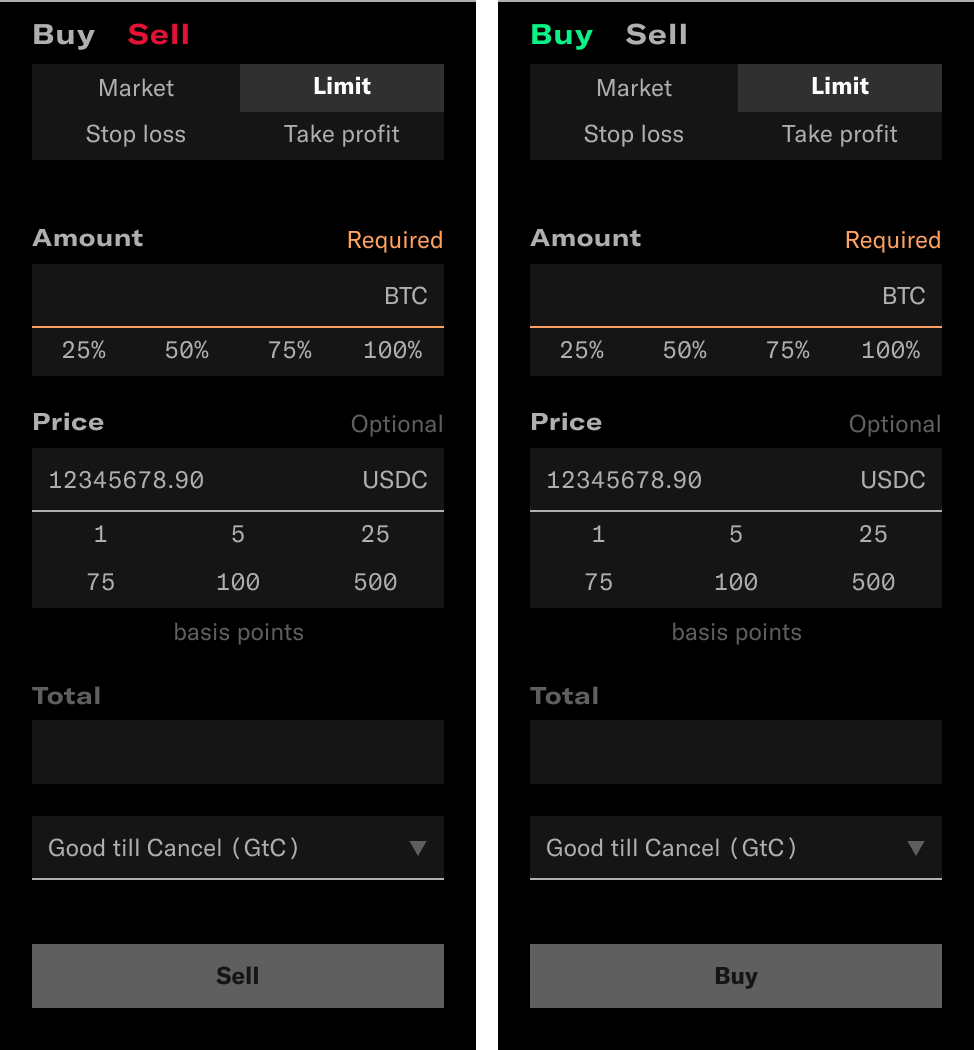

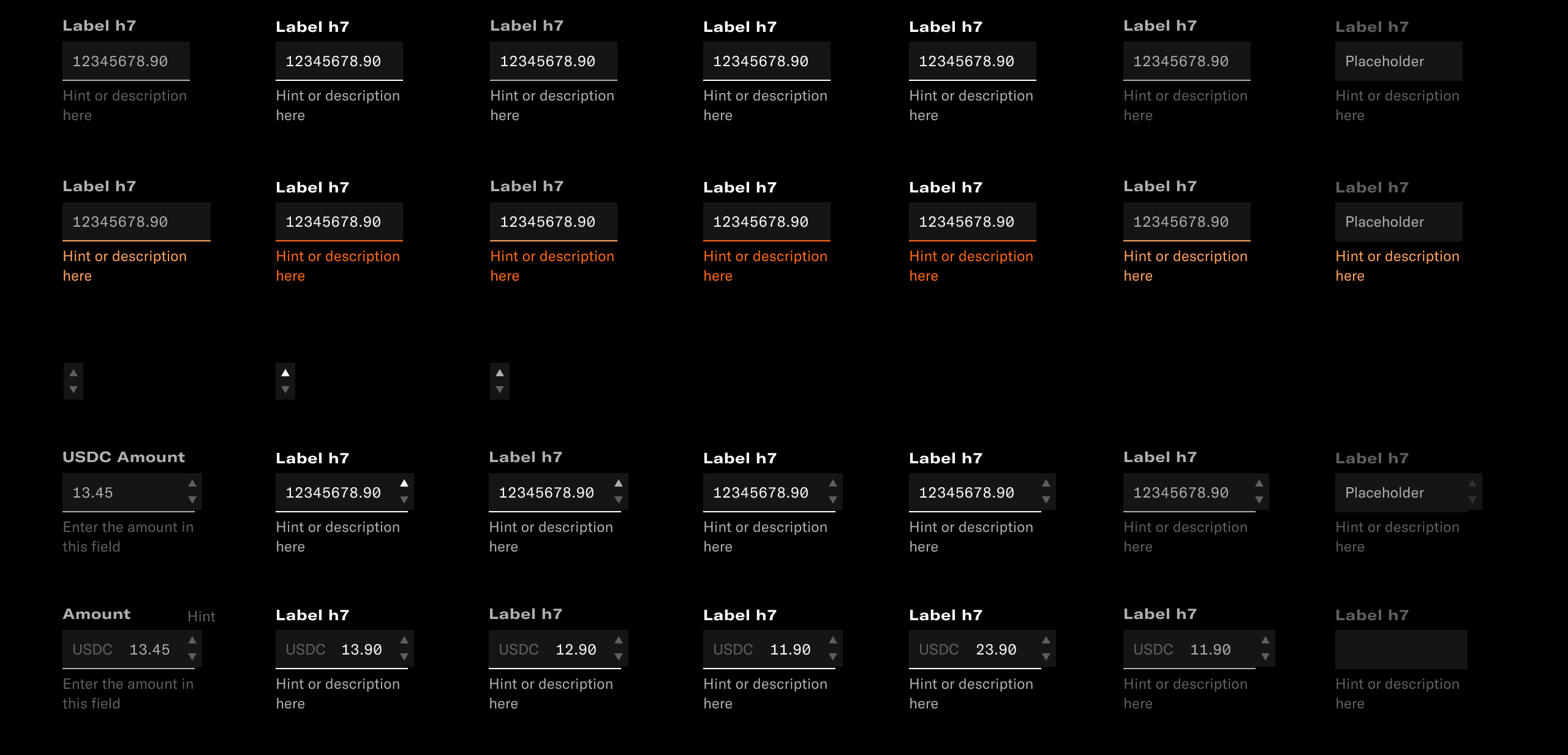

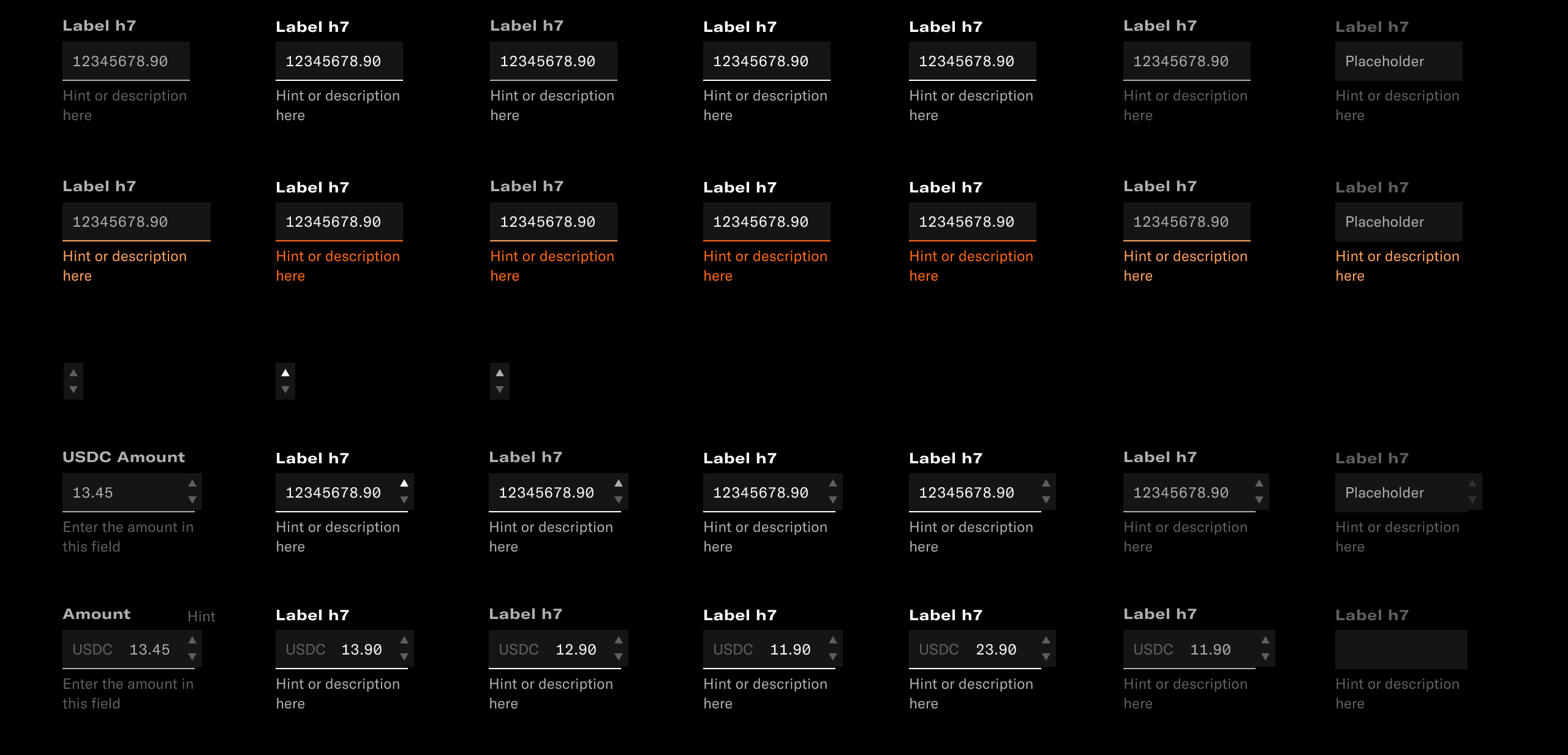

Quick Inputs

A modular subsystem to enable fast user input with predefined typical values. Microinteractions to precisely adjust bps.

Tooltips

A tooltip system that allows explanatory tooltips on any level of UI, i.e. even on each subcomponent

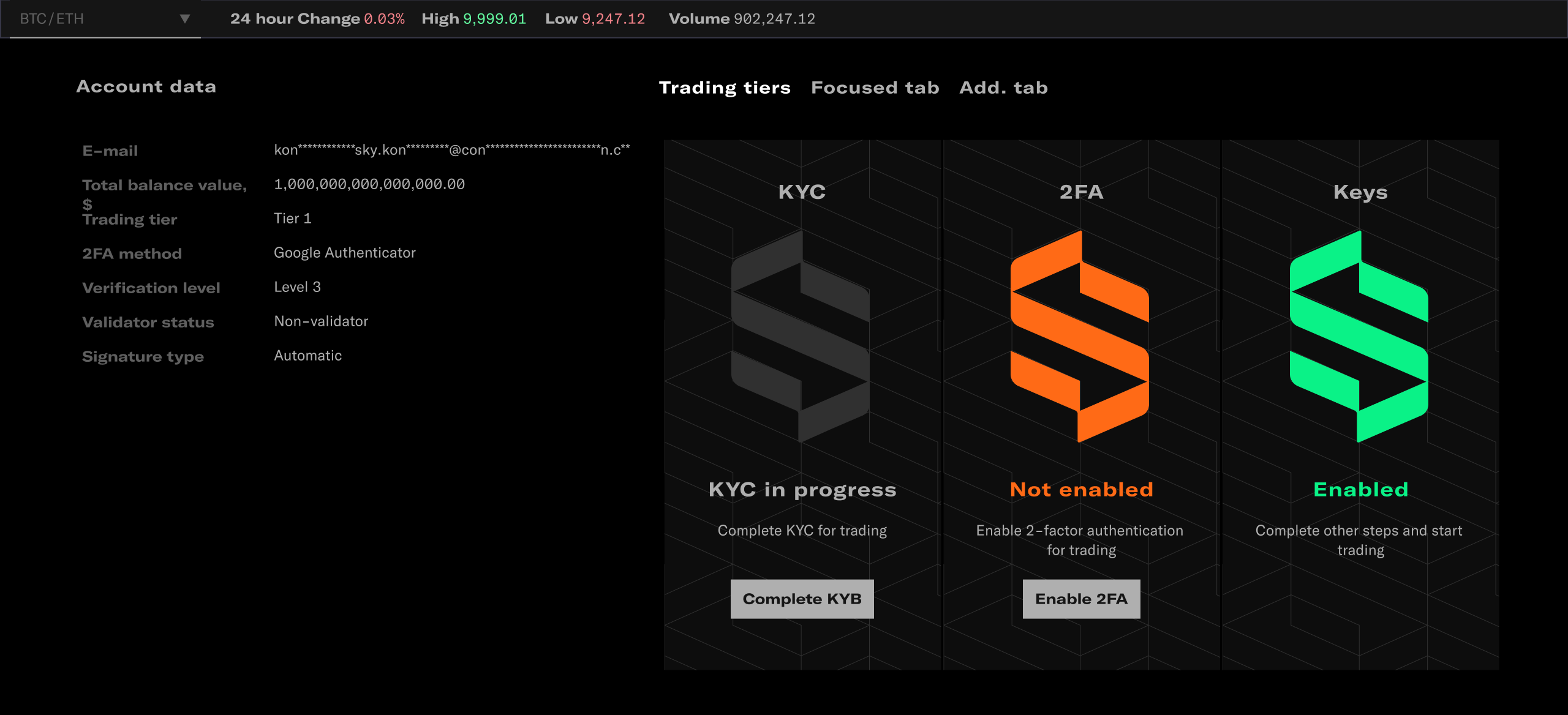

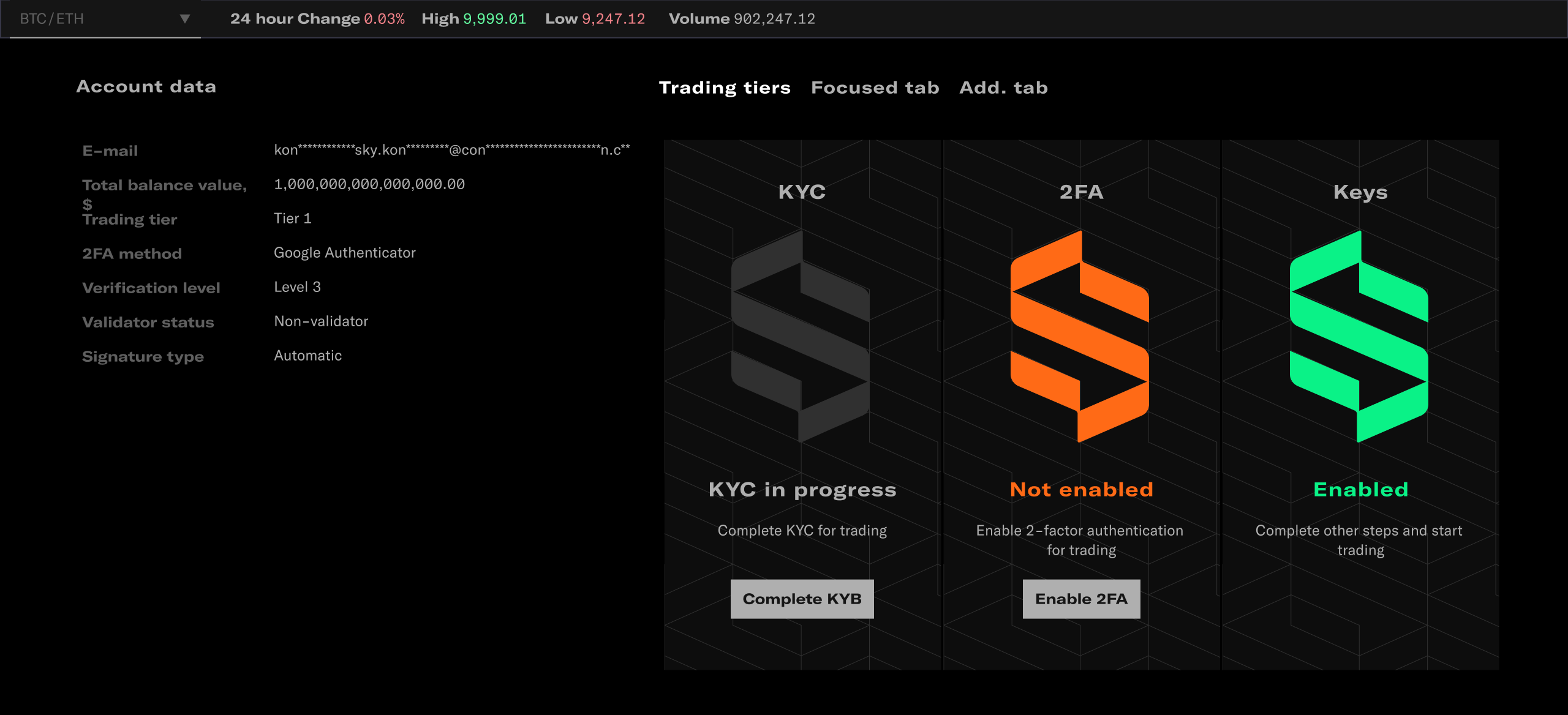

Onboarding overview

Complete all three required steps and start trading. KYC, Security, Blockchain access.

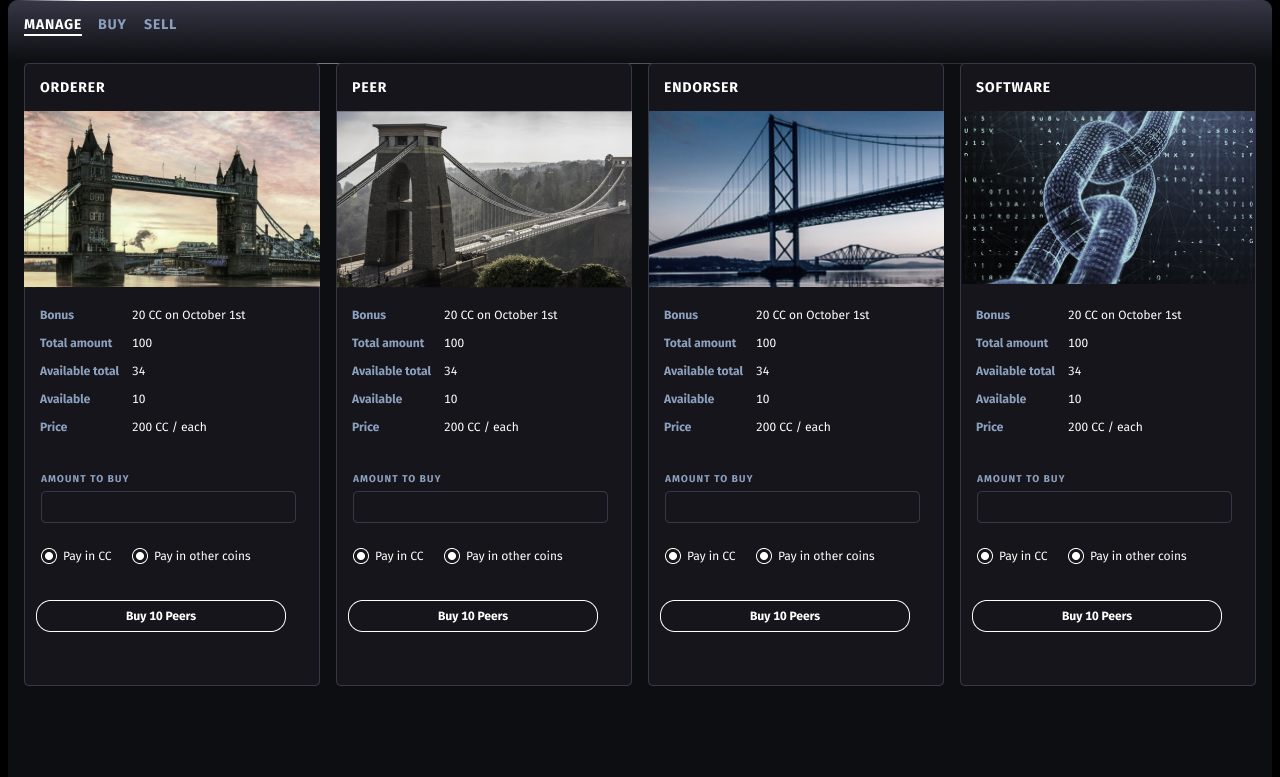

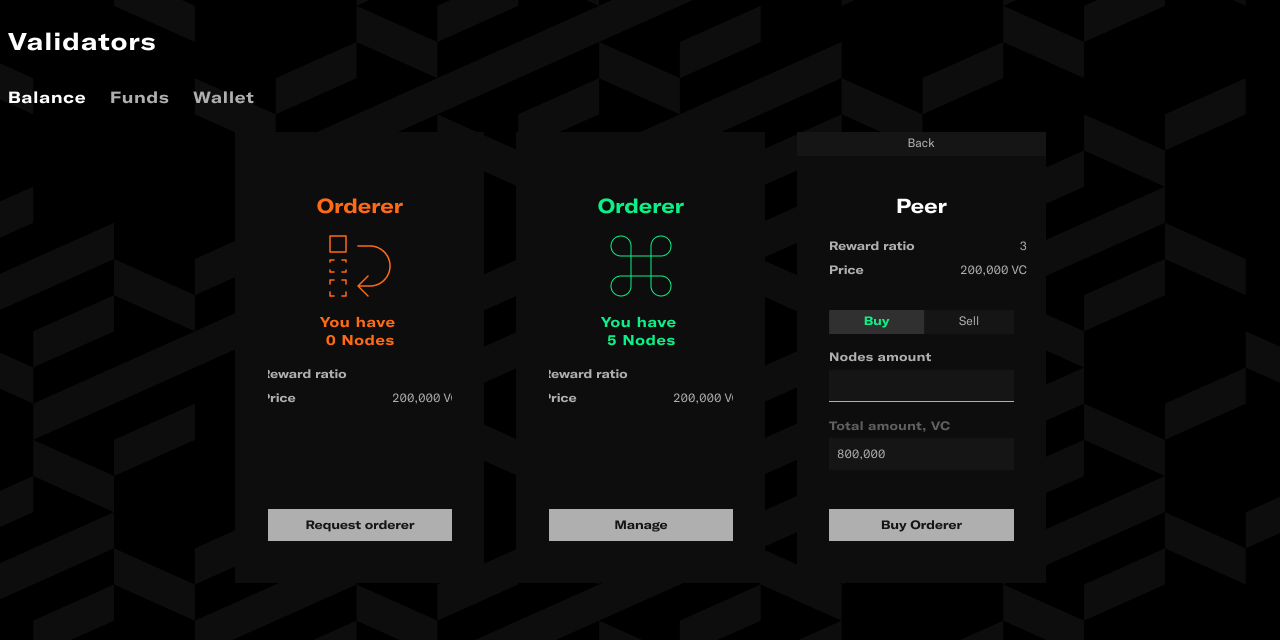

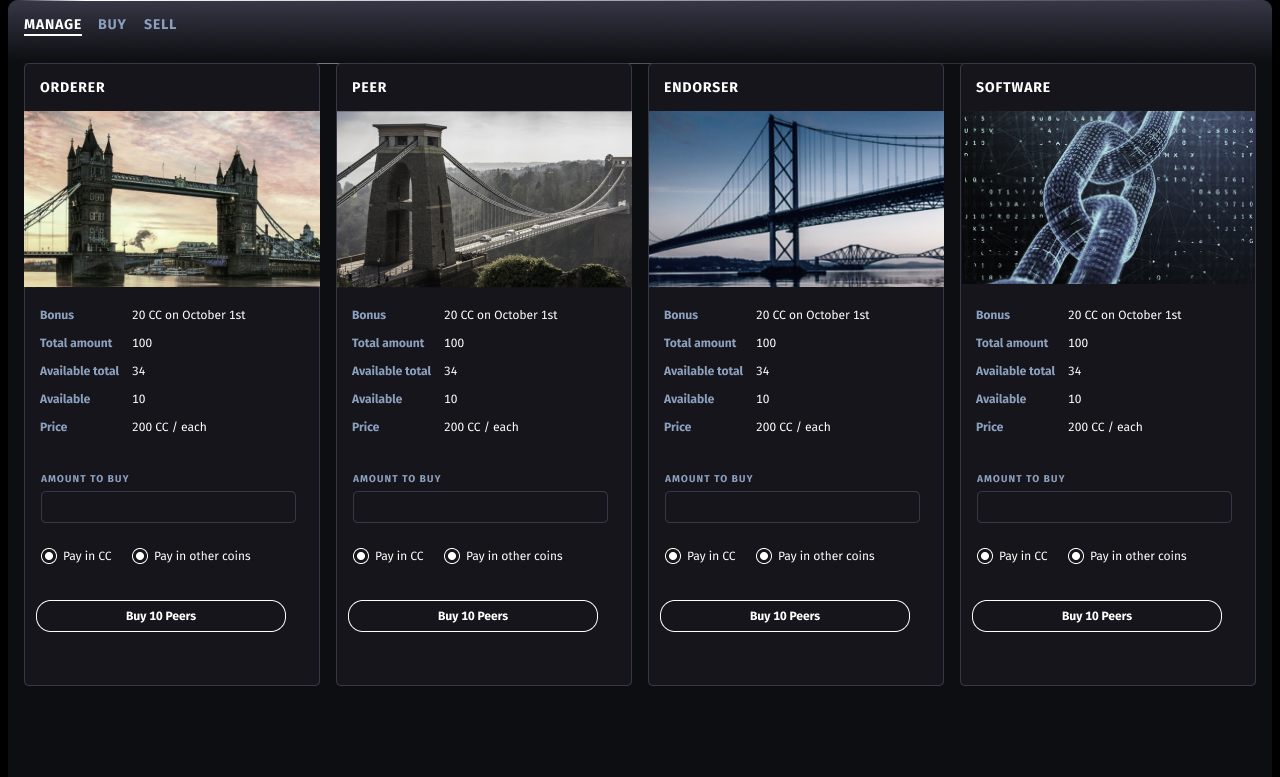

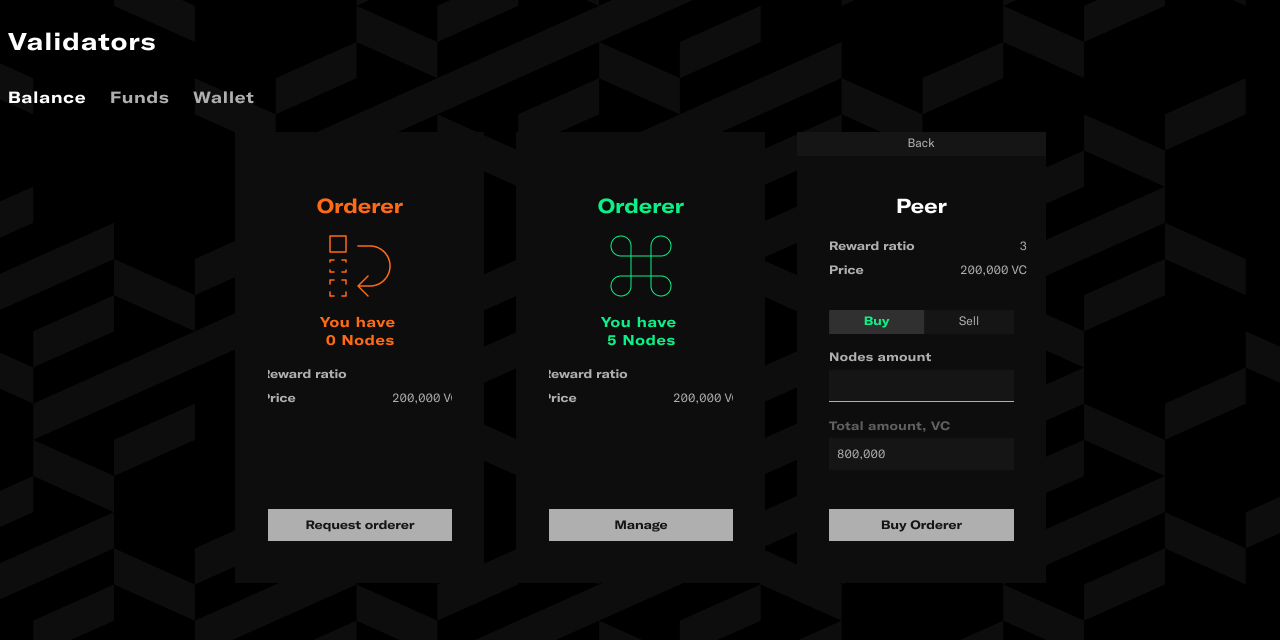

Validators

Institutional clients have an option to invest in validator nodes and earn extra money for supporting blockchain infrastructure.

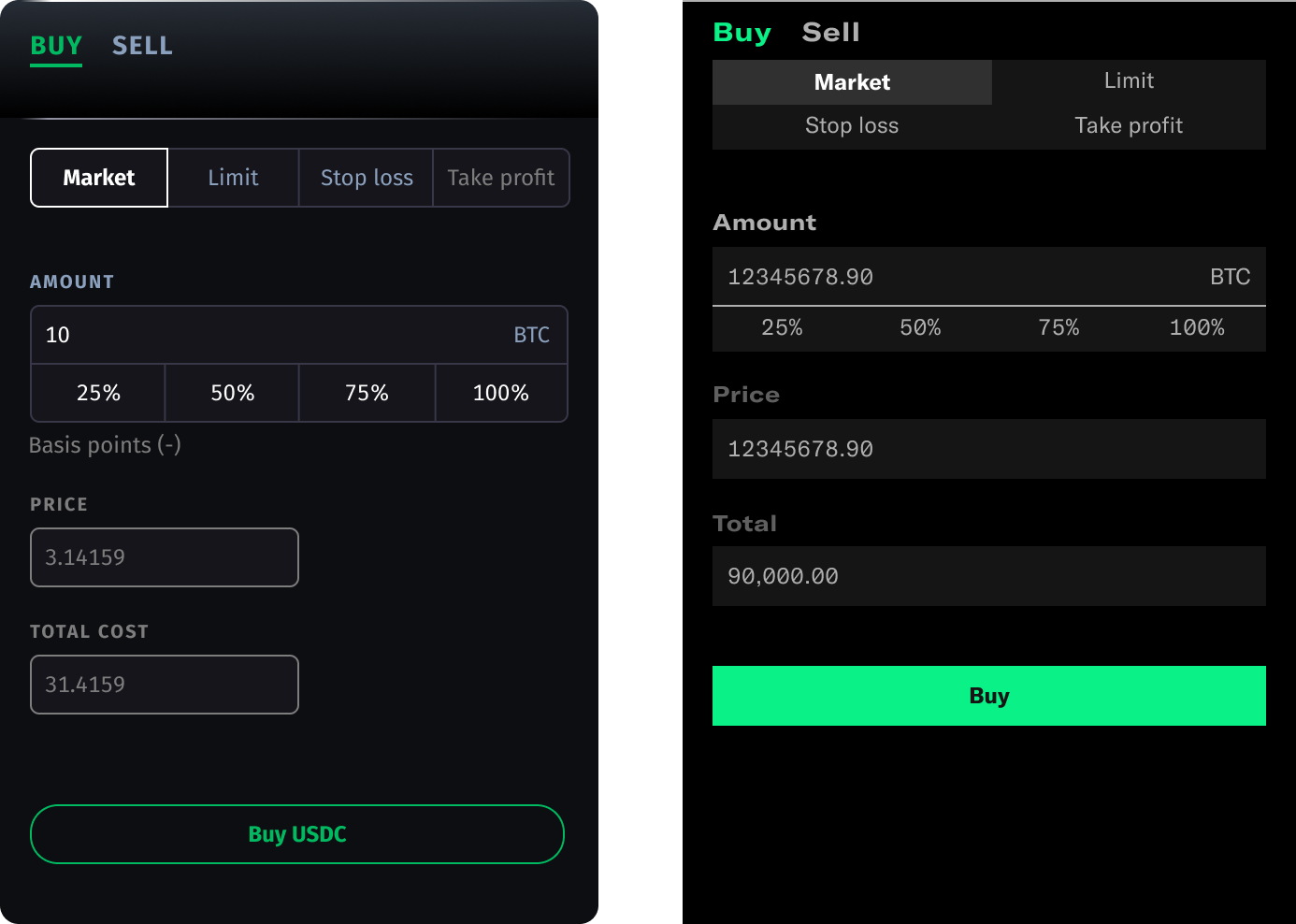

On pictures, design v1 and v2.

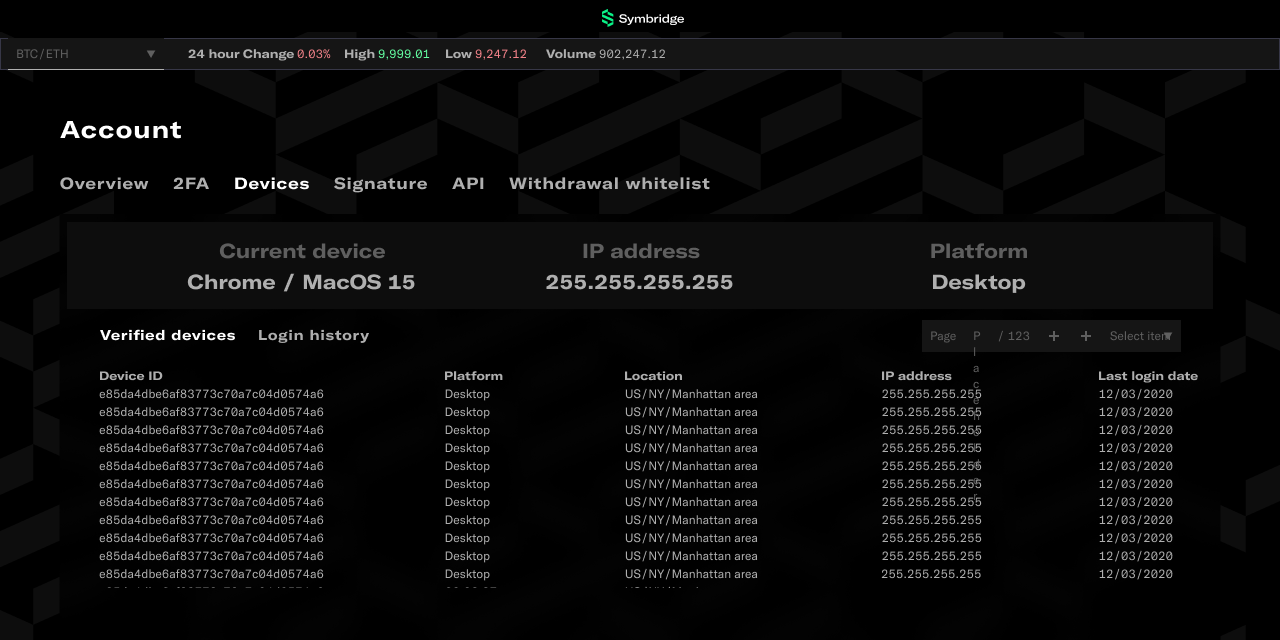

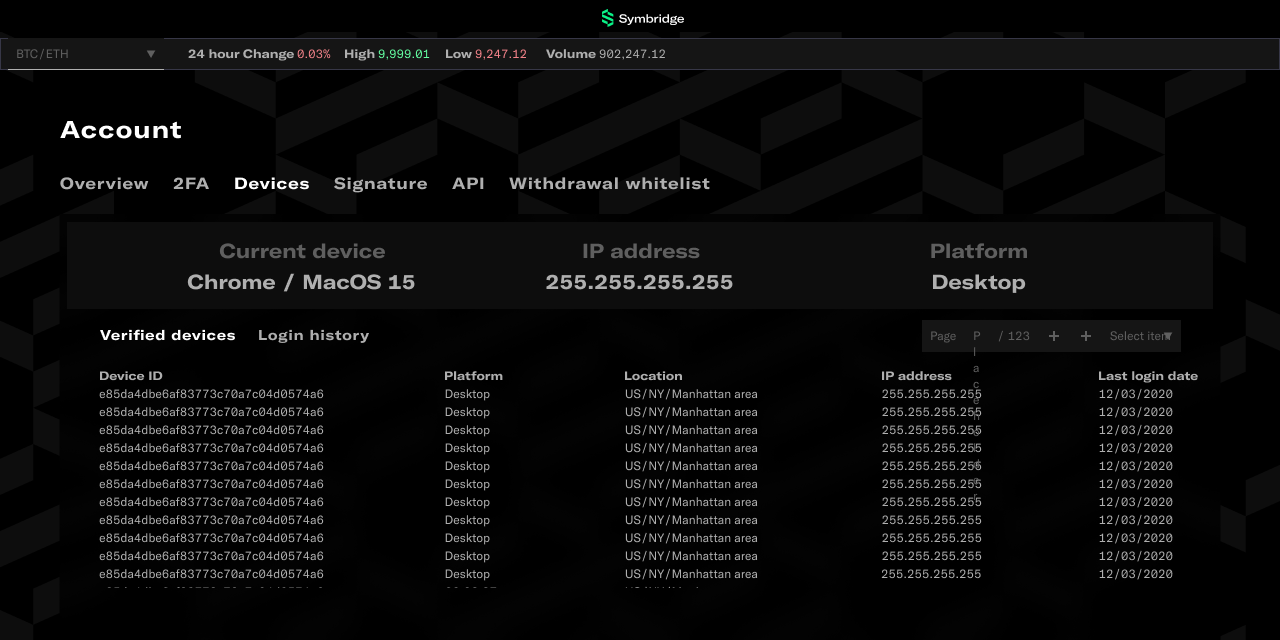

Account security: login locations

An additional way to maintain security. besides password, 2FA, key pairs, white lists, and settings in subaccounts.

RESULT: 100% design coverage for complex product meeting the institutional requirements

marketing assets

Impact: 900m Euro trading volume via OTC

Read more about otc trading

read more about tokenization platform

web3 | product design | crypto exchange

CREATING EXCHANGE FOR digital and TOKENIZED ASSETS

Symbridge digital asset exchange built specifically for future-minded traders. My goal was to create end-to-end design from scratch and apply corporate branding, which was on parallel track.

role: IC Principal designer

initial hands-off: < 1 month

CI adaptation: 3 weeks

software costs: 1 figma seat

project challenges and pecularities

Project timeline

Onboarded as IC

Kick-off and workshops week

First hands-off

CI delivery

Consulting on ecosystem CI

Research&Design

Feedback & change requests cycle

CI impl.

Design update

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sept

Oct

Nov

Dec

Jan

Feb

2019

2020

No established design process

I was the first designer onboarded and my task was not only create, well, design, but also setup the whole work environment, arrange collaboration with the developers and analytics.

I've introduced modern product design principles like doing research first, focus on user needs, change request management. I also insisted on using Figma as the primary design tool for remote collaboration, hands-off, easy versioning.

Working around visual pivot

I was involved in advising on branding creation process made by a Carbone Smolan Agency. With all client-side communication and decision making delays it was obvious we can not wait several months and need to start working on product.

I've split the project work into two major phases. The first one was focused on product features, user flows and design system, and the second one — on CI implementation, additional feedback-based updates and polishing.

OTC TRADING

SUBACCOUNTS

TRADING STRATEGIES

MARKET IMPACT CALCULATOR

VALIDATOR NODES

CONCIERGE SERVICE

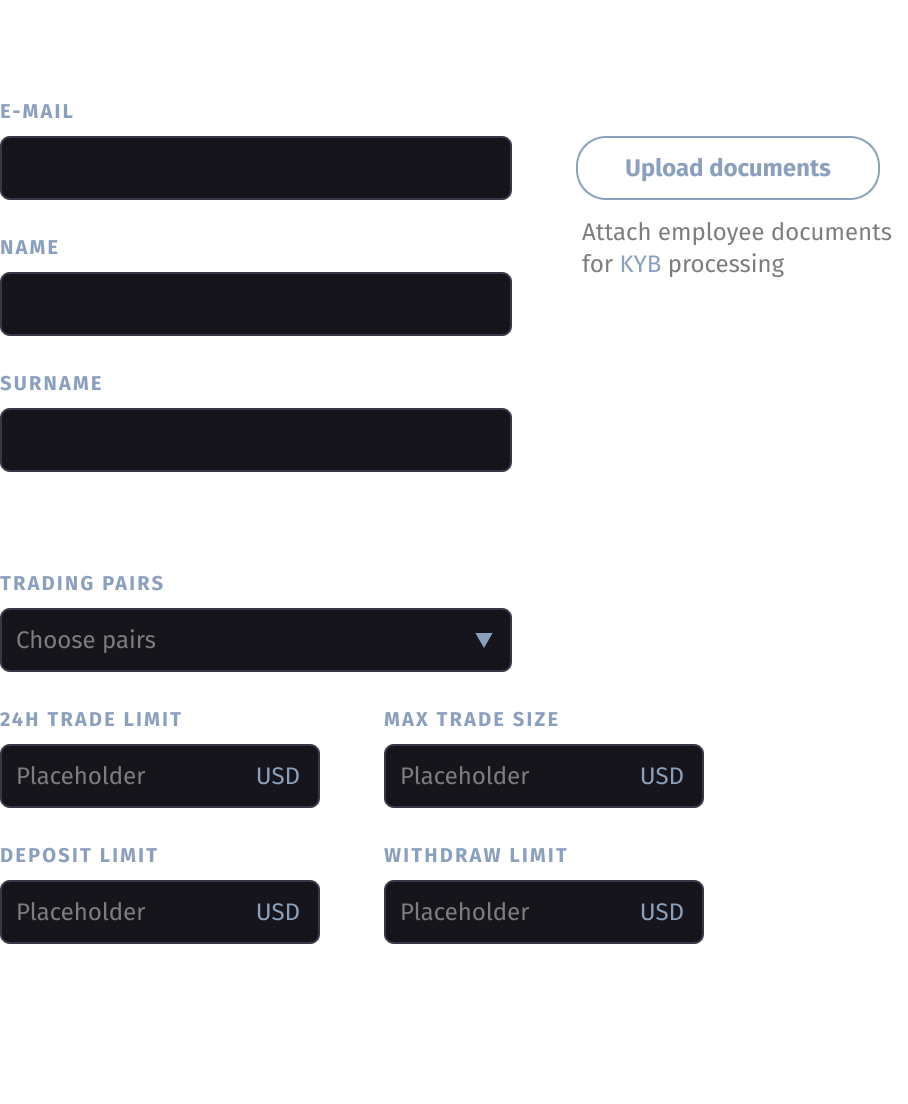

KYB process

Institutional focus

The product was focusing on institutional clients and market makers first while keeping wider audience. It added an extra level of complexity to the scope and included business features like Trading strategies, OTC trading, Subaccounts.

I've worked on design with both professionals and casual traders in mind and aimed for consistency, intuitive usability.

A new mnemonic phrase will be generated automatically if left empty

key generator

mnemonic phrase

Generate phrase

Passphrase (optional)

repeat Passphrase

Generate keys

Regulated blockchain

Symbridge was built on a deeply customized Hyperledger Fabric, and required blockchain-related tools both for security and transparency. Crypto-specific tools like key generators or blockchain explorer were also included. And Validator nodes for extra transparency (and monetization!).

design process and validation

Iterative approach

I believe in iterations in design. The whole Symbridge designing was built on multitude of iterations: ideas gathering and whiteboard validating them. Making early sketches and collecting feedback from the main stakeholders who were also professional traders and could help with usability and professional expectations. Iterating on visuals, working with feedback from the wider team and experts. Requesting peer review from other team members, including consultations on whether the proposed design can be implemented at all. Sometimes it could not, so I iterated further.

Stakeholder workshops

Obviously, there are no users in the early-stage startups. To get insights on what to include in design I've organised a week-long workshop series with professional traders and investors. I've conducted deep interviews, existing exchanges reviews and whiteboard sessions to gather ideas, insights and collect BRDs that affected the whole product.

Besides getting insights I used these workshops to connect with the analytics and development teams. We agreed on our internal workflows and also validated the most important feature ideas.

trading terminal

Classical trading exchange terminal — completely built anew to meet the highest trader's requirements.

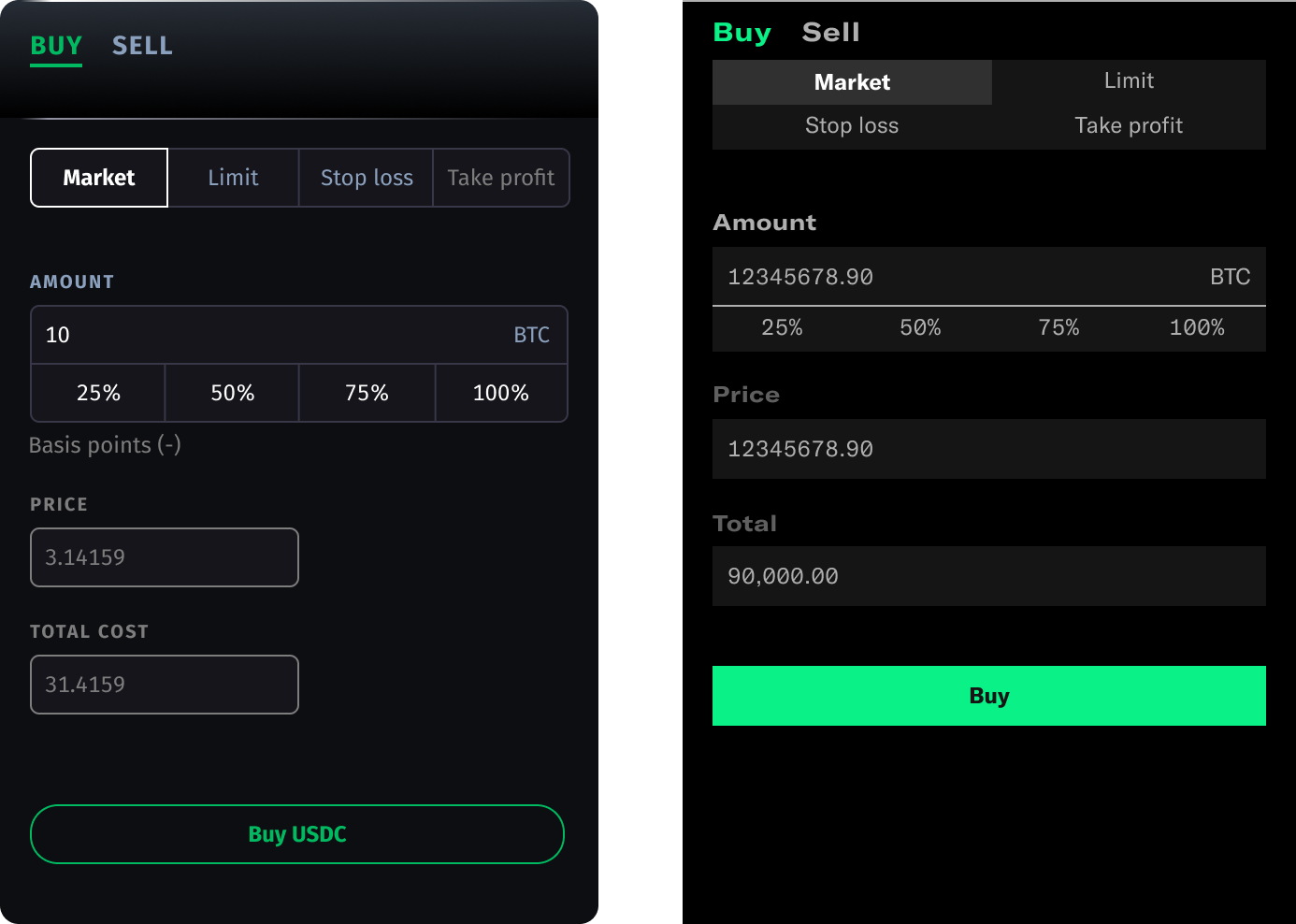

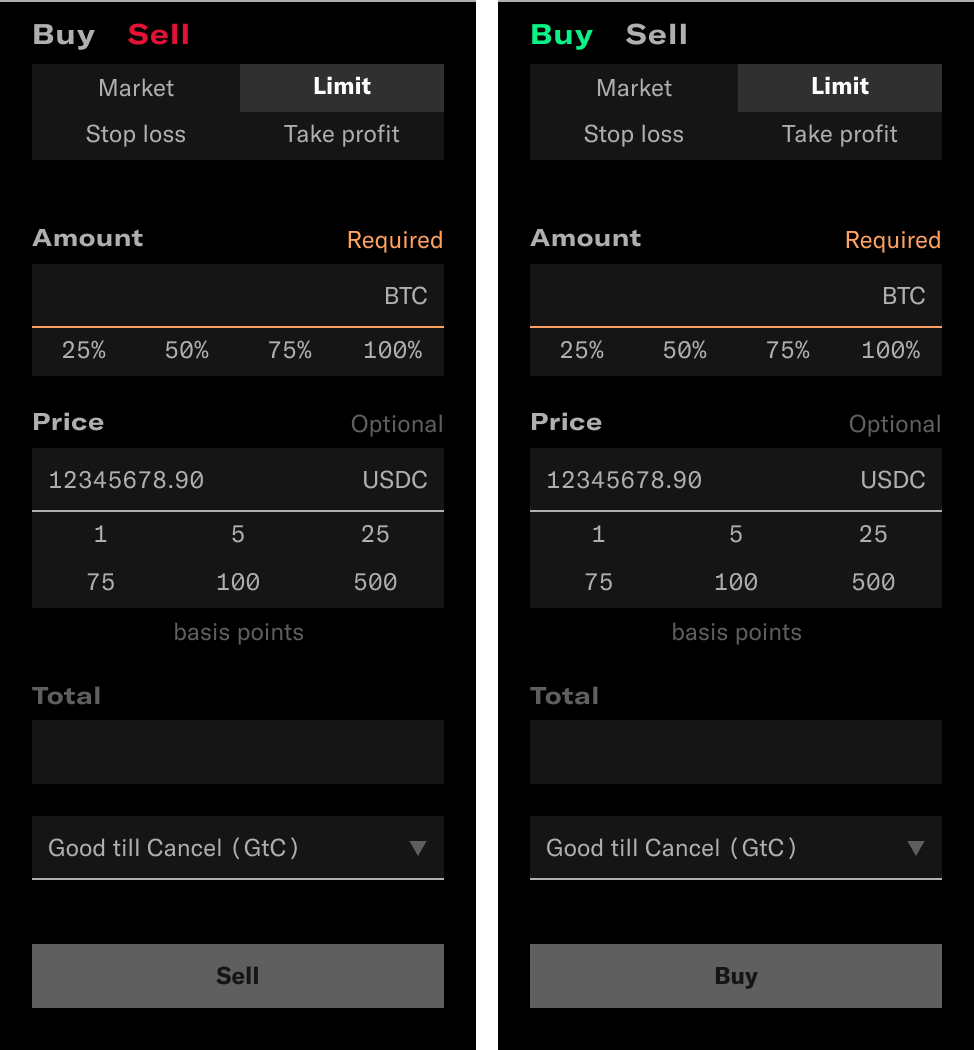

Orders with quality of life

To make trading faster and easier: bps preselects, amount preselects and different limit orders options.

Market impact calculator

Orderbook calculator to immediately estimate the impact of the order on the market

Design assets

using navigation strategically

Navigation panel in Symbridge is the entry point to the internal products and is serving so many purposes:

- Addressing the complexity of the audience. Besides classical exchange terminal it incorporates access to institutional tools, OTC trading and other products.

- Providing clarity — fast and easy access to the most important features with hierarchy representation.

- Brand communication. Menu is accessed via logo, to establish habits of getting the best out of touching the brand. And no more burger menu!

- Technical information on latency, online status and other important settings. These would clutter UI and are not needed all the time, yet have to be easily accessible.

notable features

Name

Surname

Trading pairs

Choose pairs

USD

Placeholder

24h trade limit

USD

Placeholder

MAX TRADE SIZE

USD

Placeholder

deposit limit

USD

Placeholder

withdraw limit

Create subbaccount

Upload documents

Attach employee documents for KYB processing

create subaccount

Subaccounts

Important feature for institutional clients that allows delegating funds to employees or subcontractors and trade on behalf of the owner.

Quick Inputs

A modular subsystem to enable fast user input with predefined typical values. Microinteractions to precisely adjust bps.

Tooltips

Detailed design to enable detailed explanations on different levels, from whole component to sub-components.

Onboarding overview

Complete all three required steps and start trading. KYC, Security, Blockchain access.

Validators

Institutional clients could invest in various validator nodes and earn extra money for supporting blockchain infrastructure.

On pictures, design v1 and v2.

Account security: login locations

An additional way to maintain security. besides password, 2FA, key pairs, white lists, and settings in subaccounts.

RESULT: 100% design coverage for complex product meeting the institutional requirements

marketing assets

Impact: 900m Euro trading volume via OTC

Read more about otc trading

read more about tokenization platform